Buying a brand new or even a used car is an exciting experience for most of us. It’s exhilarating to go from prospective buyer to proud owner and for some, that excitement is so overwhelming that they submit fraudulent loan applications. The practice has skyrocketed in recent years with around $1 billion worth of loan value applied for since 2019.

A new report from Point Predictive identified more than 5,000 unique fake employers cited in these fraudulent applications. Some unscrupulous prospective buyers fake employment history, pay stubs, payment history, and more just to get approval for high-dollar loans.

In some cases, criminals are actively and intentionally working with companies that create some of these fake documents for them under the guise of credit repair agencies.

“The rise in the use of fake employers on credit applications is astounding, and the $1 billion threshold only proves the growing threat of this problem,” Point Predictive senior fraud analyst Justin Hochmuth said in a statement.

Related: Nikola Agrees To Pay $125 Million To Settle Fraud Charges With SEC

The firm also said that in early 2019, they expected around $7 million worth of these fraudulent loans each month. Today, that number has grown to more than $35 million. Surely, some of that growth has occurred due to the massive bump in used car value seen in the last two years but new cars haven’t been affected in the same drastic way.

That means that the volume of fraudulent loan applications and the amount of value being requested are both growing rapidly. In fact, it’s growing so quickly that it’s impossible for them to catch every criminal before the sale is completed.

Point Predictive says that they uncover around 100 new fake employers each week and that 30 percent of the individuals submitting these fraudulent applications defaulted on their loans. And more than half of those individuals defaulted almost immediately or within six months.

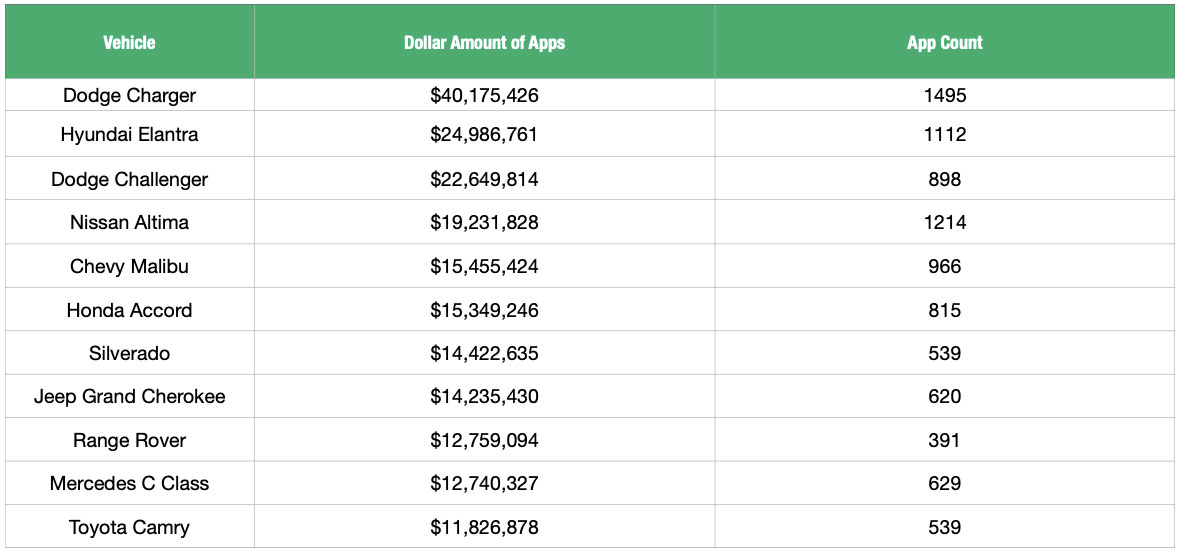

Dealers aren’t totally without recourse though. They know that the next few months represent some of the busiest for their business and that they can actively search Point Predictive’s ‘Employer Check’ page to determine if an application isn’t legit. As for the top cars people who made fraudulent applications chose, you can check the following list.

ivermectin 3 mg without a doctor prescription – ivermectina 6 mg buy generic carbamazepine online

buy isotretinoin sale – buy linezolid 600mg without prescription buy zyvox without prescription

amoxil ca – generic ipratropium 100 mcg ipratropium pills

zithromax 250mg for sale – azithromycin 500mg usa buy generic bystolic over the counter

buy prednisolone 5mg without prescription – azipro us how to get progesterone without a prescription

order generic rybelsus 14 mg – buy cyproheptadine 4mg for sale cyproheptadine 4 mg brand

buy generic cialis – viagra in usa buy sildenafil sale

sildenafil mail order usa – order generic viagra tadalafil tablets

order prilosec online cheap – cost lopressor oral atenolol

medrol 4mg otc – lyrica 75mg cheap order triamcinolone pill

order cytotec 200mcg online – orlistat 60mg price diltiazem 180mg price

zovirax 400mg us – buy acyclovir 400mg pills buy generic rosuvastatin for sale

buy domperidone without prescription – generic tetracycline 250mg order cyclobenzaprine pills

oral inderal 20mg – order clopidogrel 150mg pills buy methotrexate 10mg for sale

buy coumadin – order medex without prescription losartan 25mg brand

levaquin 500mg price – buy generic avodart over the counter order ranitidine online cheap

order nexium online – imitrex 50mg usa buy sumatriptan 25mg

order meloxicam 15mg generic – tamsulosin order purchase tamsulosin generic

buy provigil 200mg pills order generic modafinil 200mg purchase provigil pills buy provigil 100mg for sale provigil tablet brand modafinil 100mg provigil 200mg cost