California has reached 1.5 million electric vehicle sales two years ahead of its planned 2025 target for the sales milestone, according to the California Energy Commission.

With EV demand soaring, California is not the first place to reach its EV sales goals early, and it won’t be the last.

The 2025 target was originally set in 2012 by then-Governor Jerry Brown. At the time, there was only one fully-electric vehicle for sale in California, the Nissan Leaf, with the Tesla Model S set to come out later that year. The Tesla Roadster had previously been for sale from 2008-2011 (though the company still had a few vehicles in inventory at the time).

At the time, the number of electric vehicles in California numbered in the thousands, nearly all of which had been sold in the preceding year, 2011. So an increase by three orders of magnitude seemed a tall order.

And yet, like many of California’s environmental targets, the state has arrived ahead of schedule.

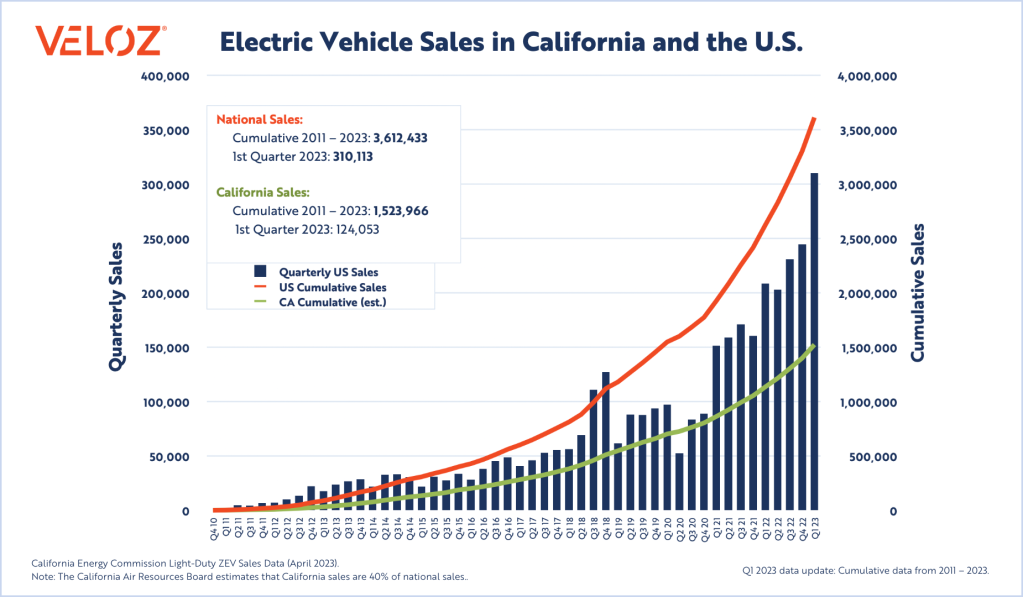

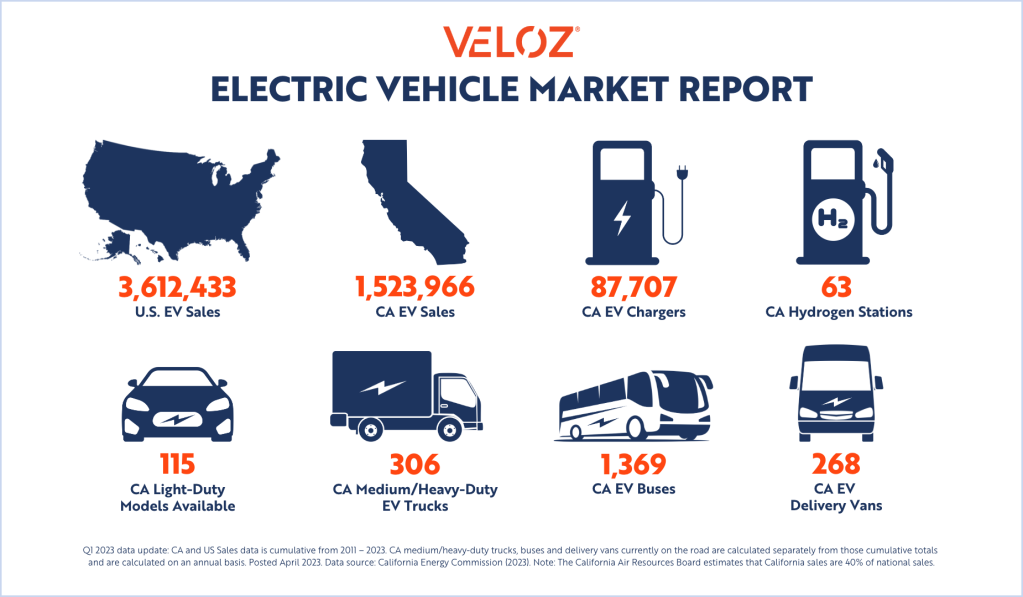

California’s EV market share for new cars so far this year stands at 21%, the highest in the US. This represents 40% of all zero-emission vehicles sold in the US. California has historically been responsible for about half of the total US EV share. In the US as a whole, EVs made up 5.6% of sales in 2022.

As of the end of Q1 2023, California now has 1,523,966 total EV sales, with 1,051,456 of those being battery-electric and the remainder mostly PHEVs, with some fuel cell cars mixed in. In Q1, a total of 124,053 EVs were sold, so the 1.5 million sales milestone was crested early this year.

The milestone has been aided by a total of $2 billion in zero-emission vehicle incentives distributed by the state over the years. That said, this is small in comparison to the estimated $649 billion in explicit and implicit subsidies that fossil fuels get every year in the US as a whole.

California’s early achievement echoes that of Norway, which targeted an end to gas car sales in 2025, but was already basically there four years ahead of schedule. It may take some time for them to completely disappear, but as of 2022, ICE-only vehicles constituted less than 7% of total car sales in Norway.

Sales of ICE cars are so sparse in Norway that some companies have had to hastily pull their gas cars from the market, with Hyundai giving only a couple of days’ notice before ending ICE car sales nationwide.

And in China, despite a slow start, consumers are now rapidly adopting EVs. The country’s EV share has risen more steeply than in many other nations, leaving ICE-powered vehicles from foreign automakers rotting on lots, unsellable due to customer disinterest and looming emissions rules changes. Toyota’s new CEO recognized today that they have fallen behind in China.

California Governor Gavin Newsom announced a planned 2035 ban on ICE-only vehicles in 2020. The ban was finalized last year, keeping the same 2035 target, though loosening it slightly to allow some PHEVs. And nationally, last week the EPA announced new emissions rules which could result in 67% of new car sales being electric in the US by 2032. However, the EPA stopped short of adopting California’s 2035 ban and instead set its regulation as a technology-agnostic emissions target, rather than a mandate of particular technologies.

Electrek’s Take

This is going to become a pattern elsewhere in the world, where lukewarm projections of EV demand will continue to catch companies and governments with their pants down (which is why we said “why not sooner?” to CA’s 2035 target).

For many years, automakers have assured us that EV demand just wasn’t there, and they’ve been proven wrong time and time again. It is clear that EV demand is much higher than anyone expected – well, anyone except for the EV-only manufacturers, us at Electrek, and various other EV advocates, who have all been shouting from the rooftops that this would happen and that manufacturers need to be ready.

And since manufacturing takes a long time to spin up, and car development has a several-year lead time, automakers need to be ready – not just for current demand but for demand years in the future.

Every EV target that gets met years ahead of schedule represents another warning to the industry that they need to be ready to accelerate their plans, lest they cede more market share to the automakers that are already prepared for EV demand – namely, the EV-only brands.

Even the EPA’s targets, which are strong but which we at Electrek consider to be eminently reachable and perhaps could be even stronger, are an acceleration from President Biden’s targets two years ago. The EPA decided that, due to advancements in technology, legislation, and the market, 50% was too low of a target for 2030 and that the US could reach 60% by then.

This 60% target means incumbent auto manufacturers will need to increase their 2030 production targets by about a third to keep up. We estimate that there is a gap of about 2 million cars in 2030 which will need to be filled with EVs that manufacturers are currently not planning to build.

But if market demand exceeds even those EPA targets, which it may well do given this history of regions exceeding EV goals, then manufacturers may have to commit to even higher EV percentages.

In short: manufacturers who have historically ignored EVs will continue to do so at their peril. Every piece of data we see shows that EVs are coming faster than the traditional industry expects, and despite a decade of confirmations showing this, many manufacturers still aren’t ready. If they want to survive, they need to step it up.

stromectol 3mg – atacand pill order tegretol without prescription

amoxil cheap – valsartan online ipratropium where to buy

zithromax sale – buy zithromax 500mg pill nebivolol generic

order omnacortil 20mg online – buy generic omnacortil over the counter where can i buy prometrium

buy furosemide pills – buy piracetam sale order betnovate online cheap

order neurontin 800mg generic – oral clomipramine 50mg order generic sporanox

purchase augmentin generic – duloxetine drug cymbalta order online

order vibra-tabs pills – generic glucotrol 10mg order glucotrol 5mg pill

augmentin 375mg pill – amoxiclav buy online order generic duloxetine 40mg

semaglutide 14 mg canada – vardenafil 10mg sale brand periactin 4mg

cialis overnight shipping – cialis over the counter buy viagra 50mg online cheap

viagra 100mg – buy tadalafil 40mg for sale cost cialis

buy atorvastatin 20mg online cheap – lisinopril over the counter lisinopril 10mg for sale

lipitor 40mg brand – buy amlodipine without a prescription order lisinopril 10mg pills

purchase lipitor online – brand zestril 5mg buy zestril generic

prilosec price – buy prilosec 10mg pills oral tenormin

methylprednisolone 16mg pills – order lyrica 75mg pills triamcinolone uk

how to get cytotec without a prescription – buy xenical 120mg for sale purchase diltiazem pill

cheap domperidone 10mg – buy domperidone without prescription flexeril us

motilium 10mg pill – sumycin generic cyclobenzaprine 15mg pills

buy propranolol online – purchase inderal generic methotrexate 5mg oral

warfarin 2mg brand – purchase warfarin generic order losartan 25mg sale

purchase nexium online cheap – sumatriptan 50mg price order sumatriptan online

order mobic 7.5mg pills – buy celecoxib 200mg online order tamsulosin 0.4mg generic