Tesla is scheduled to report first-quarter earnings for 2023 after the close of trading on Wednesday.

Here’s what analysts are expecting:

- Earnings per share: $0.85, according to the average analyst estimate compiled by Refintiv

- Revenue: $23.21 billion, according to Refinitiv estimates

Tesla’s first-quarter earnings call will be livestreamed via Twitter Spaces, a first for the electric vehicle maker. CEO Elon Musk sold billions of dollars worth of his Tesla holdings in 2022 to finance a $44 billion buyout of the social media company, where he is now also CEO.

Analysts are closely watching Tesla’s automotive gross margins after the company cut prices on its vehicles at the end of last year and into the first quarter of 2023, including additional cuts Tuesday night. At the same time, Tesla is charting ambitious plans for expansion and increased capital expenditures.

Revenue in the quarter likely increased 24% from $18.76 billion a year earlier, according to Refinitiv estimates.

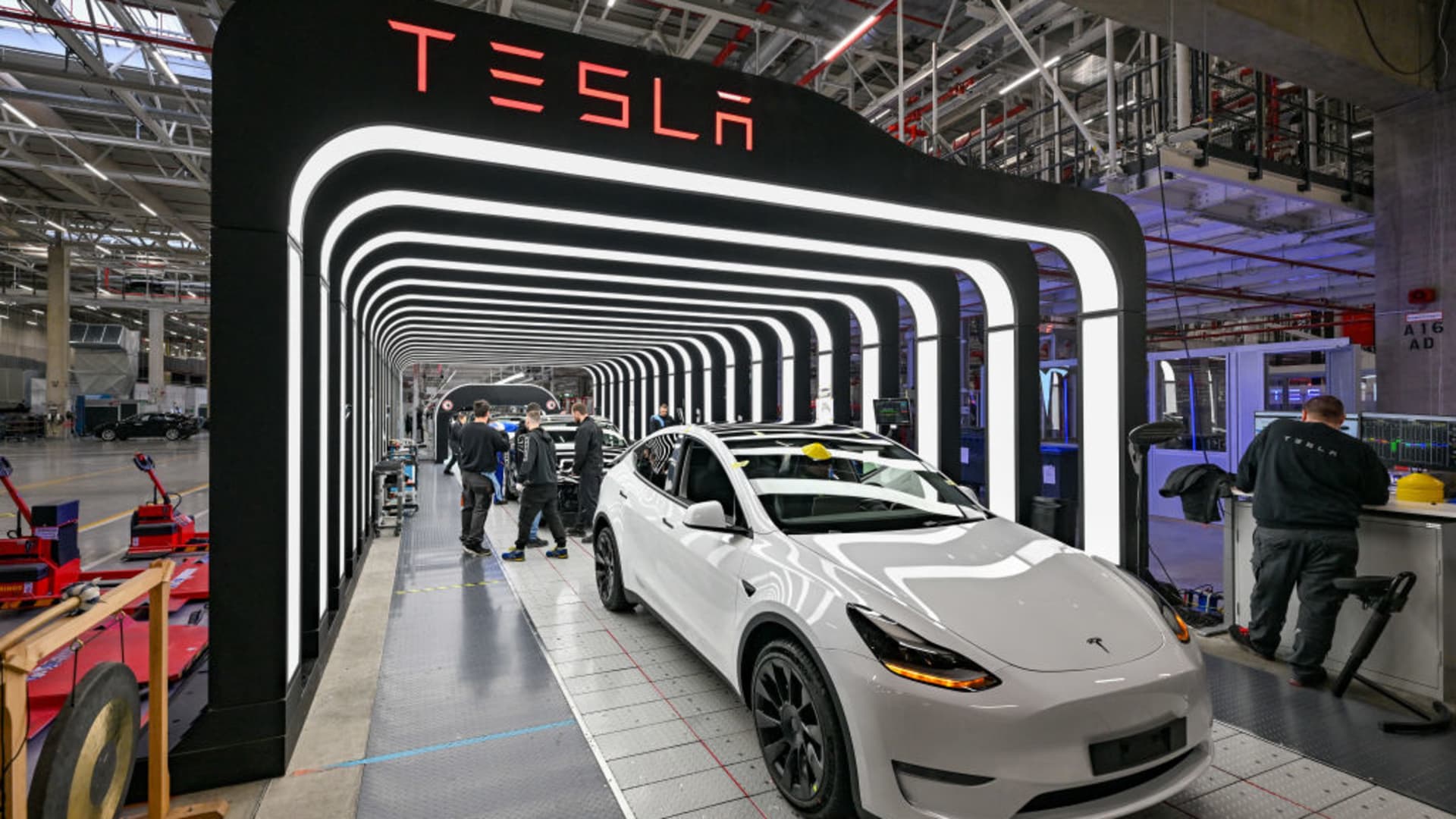

Tesla currently sells four EV models, which are produced at two vehicle assembly plants in the U.S., one in Shanghai and another outside of Berlin.

Shareholders who submitted questions ahead of the earnings call for management’s consideration were seeking updates on the company’s trapezoidal, sci-fi inspired Cybertruck, the company’s energy division, and the timing for a new model vehicle from Tesla.

In early April, Tesla reported vehicle deliveries of 422,875 vehicles in the first quarter, the closest approximation of sales disclosed by the company. Production was slightly higher than deliveries for the first three months of 2023 at 440,808 vehicles.

A month earlier, Musk announced plans to build a Tesla factory in Monterrey, Mexico, a day’s drive from a relatively new factory in Austin, Texas. And more recently, Tesla said it plans to set up a factory to make Megapacks, or large lithium ion battery-based energy storage systems, in Shanghai.

According to a financial filing published in late January, Tesla expected to spend between $7 billion and $9 billion in 2024 and 2025, an increase in capital expenditures of about $1 billion in the next two years.

Tesla shares have rebounded this year from a dismal 2022, when they lost about two-thirds of their value alongside a plunge in tech companies. The stock is up 48% in 2023.

WATCH: CFRA’s Garrett Nelson bullish on long-term earnings growth for Tesla

ivermectin without a doctor prescription – buy generic carbamazepine 400mg buy tegretol 400mg without prescription

accutane 40mg brand – decadron over the counter buy generic linezolid online

buy amoxil medication – order diovan buy combivent tablets

buy zithromax no prescription – generic nebivolol 20mg nebivolol 5mg tablet

omnacortil order – azithromycin 500mg brand prometrium tablet

gabapentin 800mg brand – buy gabapentin 100mg pills where can i buy sporanox

buy cheap lasix – betamethasone 20 gm brand3 betamethasone 20gm drug

buy generic amoxiclav – buy duloxetine cheap duloxetine 20mg cost

buy rybelsus medication – order semaglutide 14 mg without prescription brand periactin

buy tizanidine pills – how to get microzide without a prescription buy hydrochlorothiazide pills for sale

cialis 20mg ca – viagra 50mg brand oral sildenafil 50mg

order cenforce for sale – buy cenforce 100mg generic metformin over the counter

order prilosec 10mg online – cheap omeprazole 10mg buy tenormin 100mg generic

methylprednisolone 16mg otc – buy generic aristocort 4mg order aristocort 10mg for sale

buy cytotec 200mcg – order orlistat online diltiazem order

oral zovirax 400mg – acyclovir 800mg generic rosuvastatin usa

motilium 10mg oral – buy tetracycline without prescription buy cyclobenzaprine pills for sale