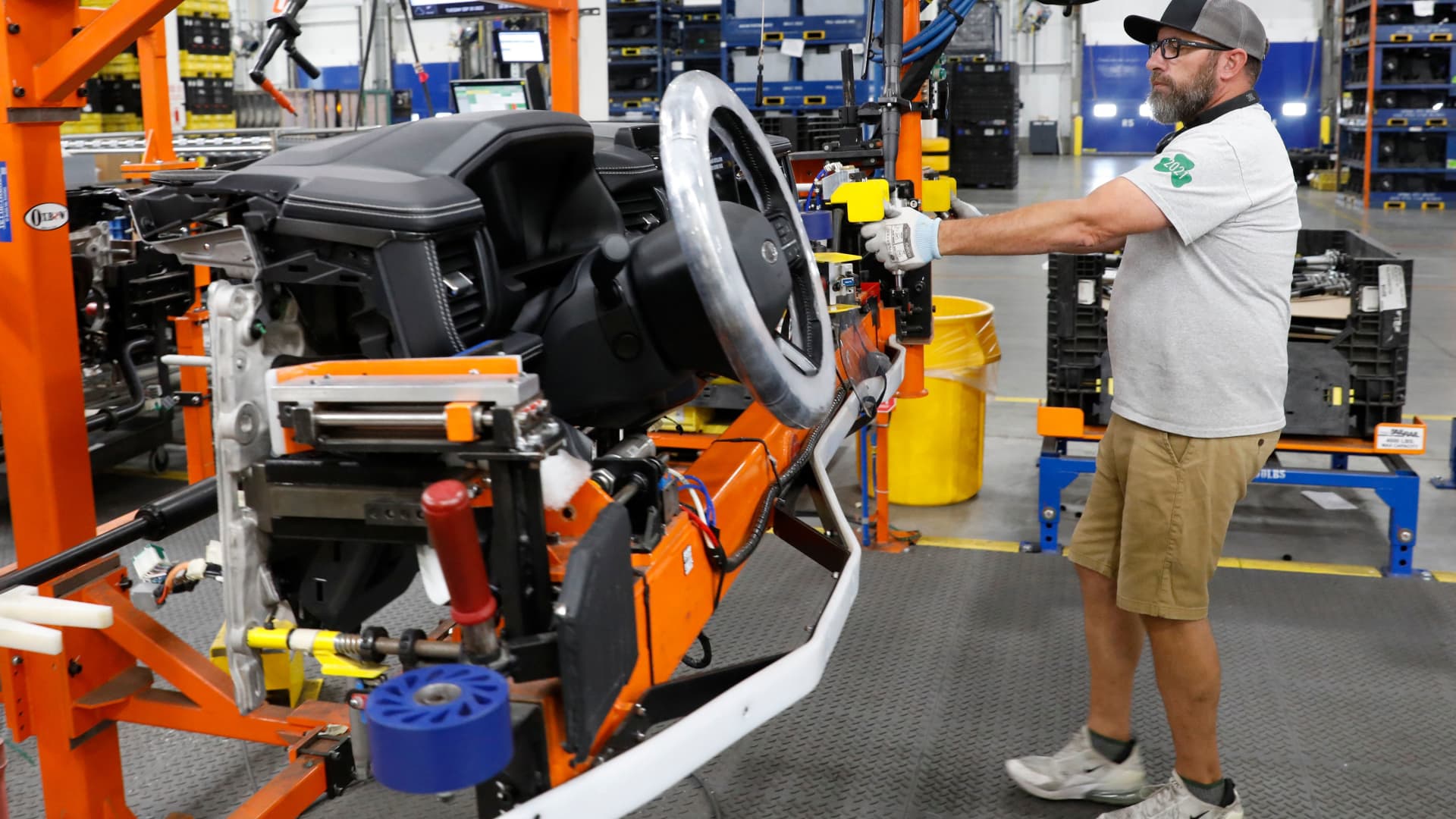

High-stakes negotiations between the United Auto Workers and Detroit automakers could lead to a strike later this month, putting added pressure on already beaten-down shares of Ford Motor (F). The risk of a walkout by the union has also created near-term uncertainty for General Motors (GM) and Stellantis (STLA) — the Dutch owner of the Chrysler, Dodge and Jeep brands, among others. The UAW’s current labor contract covering 146,000 workers at the Big 3 American automakers expires at 11:59 p.m. ET on Sept. 14. Jim Cramer’s advice: He would not look to buy more Ford on weakness nor would he look to sell Ford stock at this point. Club name Ford, which employs the most UAW members at 57,000, has seen its stock drop more than 6% in the past month. Over the same stretch, GM, which has 46,000 UAW members, declined roughly 9% and Stellantis, which has 43,000 union workers, fell roughly 7%. No matter where the talks lead, the automakers are going to see significant increases in their labor costs. The question is whether they have enough inventory to offset complications from work stoppage. Jim has been concerned about the risk of an auto strike for weeks now, stressing in his weekly column on Monday that “these negotiations are also going to be about true colors.” He added Tuesday morning that Stellantis has been the “most belligerent” and could be singled out for a walkout, to send a message to Ford and GM. Last month, rank-and-file UAW members voted overwhelmingly to grant union leaders the authority to call strikes against the three automakers, if warranted. The vote does not guarantee a strike, but it helps UAW President Shawn Fain put pressure on the automakers to meet the union’s proposals. Fain, who was elected in March, has declared “war” on the automakers. He wants to see a 46% increase in base salaries, pension increases, and a 32-hour work week as part of a list of economic demands. Ford offered last week 15% guaranteed combined wage increases and lump sums, as well as improved benefits over the life of a new contract, according to the automaker , following extensive negotiations with the union. Under such terms, wages would increase from 2022’s average of $78,000 annually to $92,000 in the first year of the contract. Workers would receive health coverage worth $17,500, and other benefits worth an additional $20,500 in the first year. Jim Cramer said that “Fain is not like the rest of the last 70 years of UAW leaders,” adding that Fain wants to go back to the 1950s. Fain filed unfair labor practice charges against GM and Stellantis for not negotiating with the union in good faith or in a timely manner . The UAW president did not file a complaint against Ford. Biden, Fain jawboning In a Labor Day speech in Philadelphia, Joe Biden said Monday that he’s “proud to be the most pro-union president” ever. Before those remarks, he told reporters, “I’m not worried about a strike. … I don’t think it’s going to happen.” For his part, Fain said he was “shocked” by Biden’s comments. The president “must know something we don’t know,” the UAW boss told reporters at a Labor Day parade in Detroit. Fain said the union has always sought to arrive at a fair contract without any strikes. “But as we get down to the wire … I know what it looks like to me,” he added, in what appeared to be a veiled strike threat. Jim has cautioned investors to wait and see what comes out of the contentious negotiations before adding to their Ford positions since concerns about a potential strike have been a “source of weakness” for the Detroit automaker. “When you’re investing in stocks, unions are the opposition: more money for workers means less money for you, the shareholder,” Jim said last month on “Mad Money.” The cost of the union demands for Ford could be a “meaningful chunk of their profits,” Jim added but maintained that a UAW strike is “definitely not a reason to sell” Ford stock. F YTD mountain Ford YTD performance Impact of a strike In the immediate term, if an agreement is not reached, “it could impact earnings by $400 million to $500 million per week of production impact for each OEM, for a total of $1.4 billion per week,” Deutsche Bank analysts wrote in their latest analysis. OEM stands for original equipment manufacturer. “We believe U.S. auto stocks could come under further pressure over the next month, as investors worry about the eventual cost of the labor agreement for the automakers and the impact from potential labor strike on OEMs,” they added. In a separate note, Wells Fargo estimates a combination of wage increases, cost of living adjustments for inflation, and ending a tiered wage system, could increase labor costs at the automakers by $2.2 billion to $3.2 billion alone. Specifically for Ford, overall UAW demands could mean roughly $8 billion in extra costs that eat into profits, according to analysts’ models. Wedbush calls a potential strike a “nightmare situation for GM and Ford,” as the legacy automakers continue their rapid transition into electric vehicles to compete with Tesla (TSLA). “Production and the EV roadmap could be pushed out into 2024 and delays would be on the horizon at this crucial period for GM, Ford, and Stellantis,” Wedbush analysts wrote. Elsewhere, Morgan Stanley said the UAW concern creates a buying opportunity for Ford calling the risks of lost units and higher wages, “manageable.” The analysts believe Ford could offset higher costs by passing on higher prices to consumers and through capital discipline. Analysts at Morgan Stanley point out that a potential strike could impact the prices of new and used cars. “Overall supply is still considered tight by historical standards,” and a walkout “could prolong supply shortages, driving new and used prices higher,” they added. Bottom line Ford shares have been pressured as investors like us are weary of the stresses associated with the UAW demands. But this is not a time to buy shares on weakness given the uncertainty of ongoing negotiations; neither is it a reason to sell. Jim Cramer has said the tensions between the UAW and Ford are in part keeping Ford stock from achieving the Club’s price target of $16. It’s true that Ford has the cash flow that could help navigate higher wages without harming its financial stability. However, in the interim, there could be more downside to the stock ahead, with increases in wages and benefits ultimately coming at a cost to shareholders as a hit to earnings. (Jim Cramer’s Charitable Trust is long F. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

High-stakes negotiations between the United Auto Workers and Detroit automakers could lead to a strike later this month, putting added pressure on already beaten-down shares of Ford Motor (F).

ivermectin for humans for sale – buy ivermectin 6mg buy carbamazepine 400mg sale

buy azithromycin cheap – zithromax 250mg cheap purchase nebivolol pill

semaglutide pill – order generic vardenafil 10mg order periactin 4 mg for sale

viagra drug – sildenafil 100mg us order cialis 20mg sale

prilosec without prescription – treat stomach atenolol price

medrol pill – triamcinolone 10mg for sale aristocort online buy

generic misoprostol 200mcg – diltiazem 180mg pill diltiazem 180mg uk

zovirax 800mg cost – buy allopurinol cheap oral rosuvastatin 10mg

domperidone tablet – cyclobenzaprine 15mg us buy cyclobenzaprine 15mg generic