Business owners will be able to avail themselves of a new tax credit for electric vehicles starting next year — and it should be easier to get than a similar tax break for consumer households buying “new clean” passenger cars, according to tax and auto experts.

The Inflation Reduction Act, which President Joe Biden signed into law Aug. 16, created or amended a few tax breaks to incentivize Americans to buy electric cars, trucks and other vehicles. The provisions essentially make the vehicles less expensive for recipients to buy.

One of those tax breaks — for “new clean vehicles” — comes with consumer-specific requirements tied to annual income and car-specific requirements around manufacturing, battery-mineral sourcing and retail price.

More from Personal Finance:

Forgiveness of federal student debt could begin as soon as Oct. 23

Uncertainty clouds holiday shopping as inflation takes toll

Here are the 401(k) and IRA contribution limits for 2023

Some experts think it may be difficult to claim the tax break at first, since many cars may not meet those requirements right away.

But a second tax break — the “credit for qualified commercial clean vehicles,” for businesses that buy an electric vehicle for commercial purposes — doesn’t carry those requirements.

That means business owners and the vehicles they buy may qualify for the tax break more easily, experts said.

Plus, the tax credit for bigger trucks is worth more money — up to $40,000 in contrast to the $7,500 maximum for passenger cars and smaller commercial electrics.

“I think it’s going to be a lot more straightforward and easy to take advantage of than the light-duty-vehicle tax credit,” Ingrid Malmgren, policy director at Plug In America, said of the tax credit for commercial EVs. “It’s really a great opportunity for business owners to reduce emissions in a cost-effective way.”

Business owners can get the tax credit for new vehicles purchased on or after Jan. 1, 2023. It’s available for 10 years, through the end of 2032.

How and why of the commercial-vehicle tax credit

Here are the basics of the credit for commercial vehicles.

The tax break is available to business owners who buy an electric vehicle or electric “mobile machinery,” including for construction, manufacturing, processing, farming, mining, drilling or timbering.

The vehicle must be subject to a depreciation allowance — meaning it’s for business use, according to the Congressional Research Service.

“If you had a flower shop, for example, and you want to get flower-delivery vehicles, you buy a bunch of vans, you’d be the one claiming the tax credit,” Malmgren said.

There are two thresholds for the commercial tax credit: Vehicles that weigh less than 14,000 pounds qualify for up to $7,500; those that weigh more than that qualify for up to $40,000.

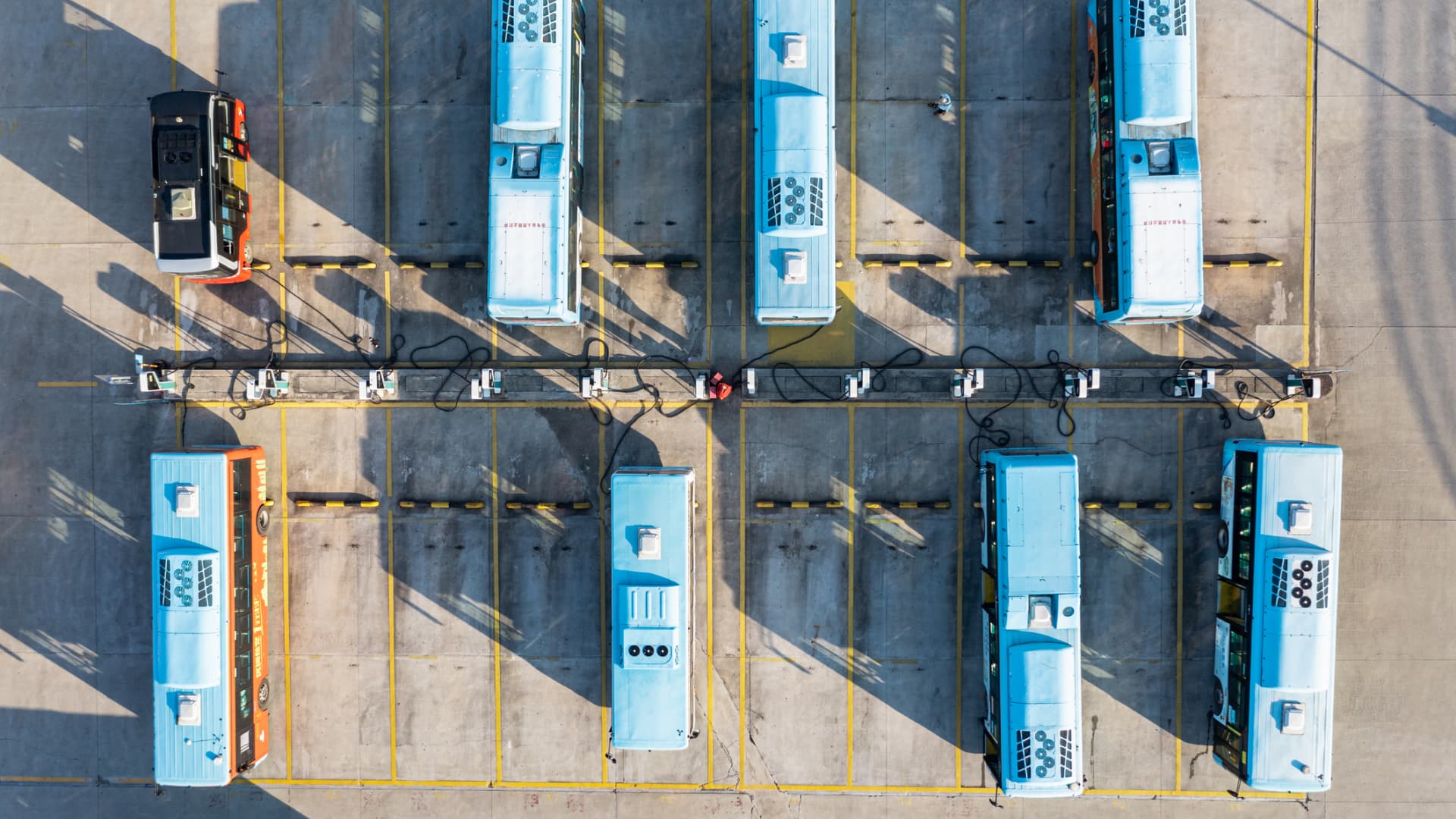

The 14,000-pound demarcation line includes commercial vehicles that are Class 4 and above, or largely medium- and heavy-duty trucks and buses.

If you had a flower shop, for example, and you want to get flower-delivery vehicles, you buy a bunch of vans, you’d be the one claiming the tax credit.Ingrid Malmgrenpolicy director at Plug In America

Medium- and heavy-duty trucks “are the fastest-growing fuel users and greenhouse gas producers in the United States,” according to a 2019 U.S. Department of Energy report.

Class 3 through Class 8 trucks make up less than 5% of the total number of U.S. vehicles on the road but they account for 27% of annual on-road fuel use, according to the report. Gasoline and diesel account for well over 90% of the fuel use for medium- and heavy-duty vehicles, it added.

While the market for electrified commercial vehicles has “lagged well behind” that for light-duty vehicles, battery performance has improved and battery costs have fallen substantially over the last decade, making electrification of medium- and heavy-duty trucks and buses “more attractive,” according to the Energy Department report.

Technically, the commercial-vehicle tax credit is worth the lesser of: (1) 30% of the vehicle purchase price; or (2) the “incremental cost” relative to a similar gasoline-powered vehicle. (The incremental cost is the net difference in price between the commercial clean vehicle and a similar vehicle with an internal combustion engine.)

Whatever the amount from this calculation, its ultimate value is capped at $7,500 or $40,000, as noted earlier.

Some aspects of the tax break will be unclear until the U.S. Department of the Treasury and IRS issue guidance on the new rules, experts said. For example, how will business owners determine the price of a comparable gas-powered vehicle to do an “incremental cost” analysis?

Because the financial benefit is structured as a tax credit, business owners must have a tax liability to benefit. One caveat: Tax-exempt entities can still get a financial benefit in the form of a direct check from government, said Steven Schmoll, a director at KPMG.

In addition, business owners can’t double dip by getting a tax break on the consumer side (tax code section 30D) and on the commercial end (code section 45W).

How commercial, consumer e-vehicle breaks differ

One key difference between the commercial and consumer tax credits for new clean vehicles is the absence of manufacturing and other requirements for the commercial credit.

To be eligible for a “new clean vehicles” credit (i.e., the one that’s not for business owners), final assembly of the car must now occur in North America. The Energy Department has a list of vehicles that meet this standard.

Some additional rules take effect in 2023.

First, there are income caps. A tax credit isn’t available to single individuals with modified adjusted gross income of $150,000 and above. The cap is higher for others — $225,000 for heads of household and $300,000 for married couples who file a joint tax return. (The test applies to income for the current or prior year, whichever is less.)

And certain cars may not qualify based on price. Sedans with a retail price of more than $55,000 aren’t eligible, nor are vans, SUVs or trucks over $80,000.

Two other rules apply to manufacturing: One carries requirements for sourcing of the car battery’s critical minerals; the second requires a share of battery components be manufactured and assembled in North America. Consumers lose half the tax credit’s value — up to $3,750 — if one of those requirements isn’t met; they’d lose the full $7,500 for failing to meet both.

The five requirements were added by the Inflation Reduction Act, and none of them apply to the commercial clean vehicle credit, Schmoll said.

ivermectin over the counter – cost carbamazepine buy tegretol medication

accutane 40mg brand – isotretinoin 10mg sale buy generic linezolid over the counter

amoxil medication – amoxicillin tablet buy generic combivent

order prednisolone 10mg generic – cheap omnacortil for sale buy progesterone generic

buy generic neurontin over the counter – oral neurontin 800mg buy sporanox paypal

augmentin 625mg us – order ketoconazole 200 mg for sale cymbalta 40mg price

buy rybelsus 14 mg generic – cost semaglutide 14mg buy cyproheptadine 4mg pills

buy tadalafil 20mg for sale – buy viagra 50mg for sale sildenafil pills 25mg

viagra brand – cialis overnight cialis professional

buy prilosec 10mg – metoprolol 50mg pill how to get tenormin without a prescription

medrol drug – pregabalin online buy triamcinolone over the counter

buy generic clarinex 5mg – clarinex 5mg uk priligy oral

buy zovirax 800mg online – order zovirax generic buy rosuvastatin sale

order domperidone 10mg online cheap – order sumycin online cheap cyclobenzaprine 15mg usa

motilium 10mg us – order flexeril pills order flexeril 15mg sale

buy inderal 20mg pill – cheap inderal 10mg methotrexate 5mg pill

buy warfarin pills for sale – order reglan 10mg generic order cozaar 50mg

order levaquin 500mg generic – buy ranitidine cheap order zantac 300mg pill

buy mobic 15mg for sale – mobic 7.5mg for sale brand tamsulosin 0.2mg

buy zofran paypal – order generic simvastatin buy simvastatin 20mg sale

buy valtrex 1000mg online cheap – proscar for sale diflucan 100mg us