Tesla’s stock (TSLA) crashed 7% today following earnings that actually met expectations. So what is the problem? Is Tesla losing its credibility?

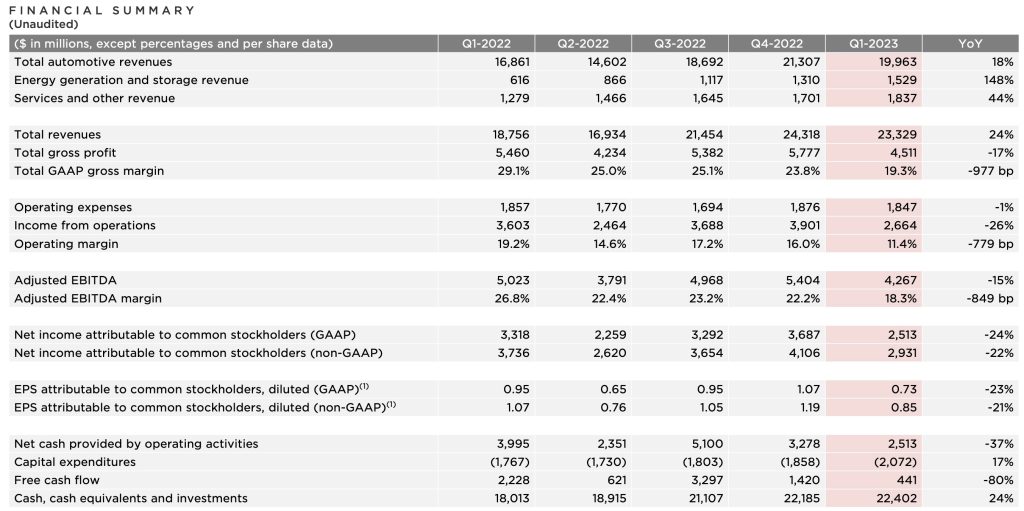

Yesterday, Tesla released its Q1 2023 financial results and met earnings expectations of $0.85 per share and even surprised many by maintaining an automotive gross margin over 19% despite significant price cuts during the quarter.

Tesla was still able to deliver an operating margin of 11% during the quarter and added hundreds of millions to its cash position.

Tesla’s costs have also improved this quarter, and the automaker shows room to be able to absorb the new price cuts that were implemented after the end of the last quarter.

That’s why it’s surprising to see the stock crashing 7% this morning after the market opened. What is happening?

Electrek’s Take

Obviously, I don’t know for a fact, but I have my suspicions. I think Tesla might be losing some credibility here.

Many Tesla fans were holding on to the idea that Tesla was reducing prices to start a price war and not because it needed to create demand. These results and the automaker’s comments yesterday confirmed what most people knew to be true: Tesla needed to reduce the price to create enough demand to match its production. Period.

But at the same time, the automaker tried to explain its pricing strategy by claiming that it is banking on achieving higher profits on the vehicles it is selling right now at lower gross margins by making them self-driving and selling future software features and subscriptions.

I think that’s where it is losing credibility.

Musk seems to believe that people don’t understand the value that Tesla can create by making its electric vehicle self-driving.

The truth is that everyone understands the value, but fewer and fewer people are starting to believe that Tesla can deliver on its full self-driving promises. That’s the issue.

Tesla had a significant rise in stock price because it was selling more electric vehicles than anyone at a higher gross margin than anyone.

Now this is still true, but the latter is starting to become less accurate. That’s it.

It pushes people to have more concerns about Tesla’s demand. However, to be fair, I think the bulk of Tesla’s demand issues leading to those price cuts are mostly not Tesla’s fault. The high interest rates and economic uncertainty are certainly the biggest factors leading people to postpone new car purchases.

Therefore, if we see a turn around in those factors, I think Tesla will see strong demand again and won’t need to cut prices further, but the problem is that those are factors entirely out of Tesla’s control.

ivermectin 3 mg for humans – ivermectin 12mg tablet purchase tegretol pill

accutane 10mg us – isotretinoin where to buy order linezolid generic

amoxil order – order valsartan pill combivent 100 mcg brand

buy zithromax tablets – tinidazole 500mg for sale nebivolol 5mg price

generic prednisolone 5mg – azithromycin 250mg us buy prometrium 200mg for sale

clavulanate generic – order nizoral for sale order cymbalta pill

where can i buy doxycycline – order glipizide 5mg for sale purchase glipizide online cheap

buy augmentin 625mg without prescription – buy augmentin 625mg pills cymbalta price

semaglutide 14mg sale – levitra pills periactin 4 mg us

buy zanaflex generic – cost hydroxychloroquine 400mg hydrochlorothiazide sale

tadalafil over the counter – order tadalafil 40mg without prescription viagra online buy

sildenafil overnight delivery – order sildenafil 50mg sale tadalafil 5mg cheap

order lipitor 80mg for sale – order lisinopril 10mg generic lisinopril without prescription

cenforce 100mg usa – buy glucophage 500mg online buy metformin online

atorvastatin for sale online – norvasc 5mg drug prinivil price

prilosec price – order lopressor 50mg buy tenormin

desloratadine over the counter – claritin us order priligy 90mg without prescription

cytotec 200mcg generic – cytotec ca order diltiazem without prescription

buy acyclovir tablets – buy crestor 10mg generic rosuvastatin price

brand domperidone 10mg – order generic motilium order flexeril 15mg for sale

domperidone buy online – cyclobenzaprine tablet cost cyclobenzaprine

buy inderal 20mg online – clopidogrel 150mg usa methotrexate 5mg cost

warfarin 5mg tablet – warfarin 5mg uk order losartan generic

order mobic 15mg pill – purchase meloxicam generic order tamsulosin 0.2mg sale

buy ondansetron sale – zocor 10mg sale simvastatin 10mg pills

buy valacyclovir 500mg generic – buy fluconazole online where to buy diflucan without a prescription